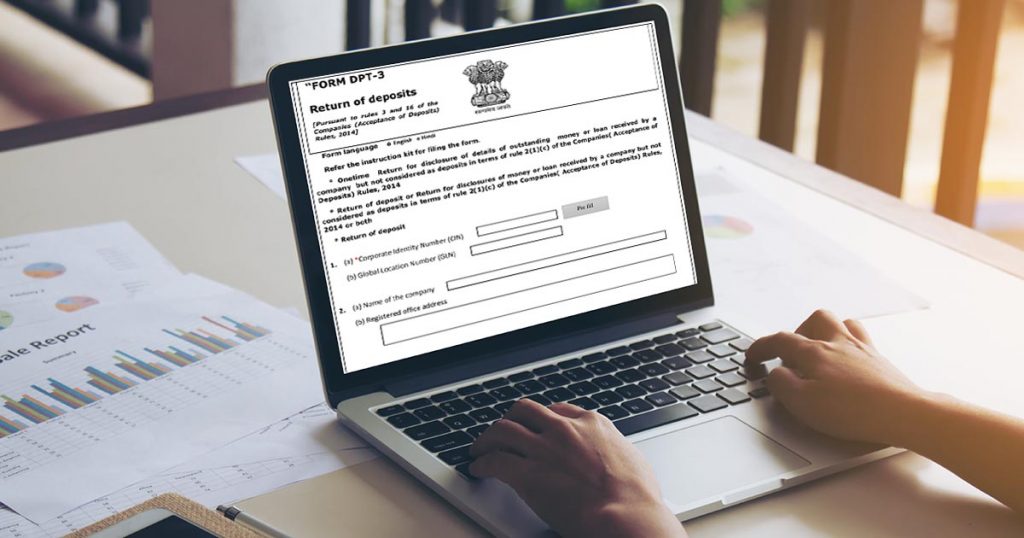

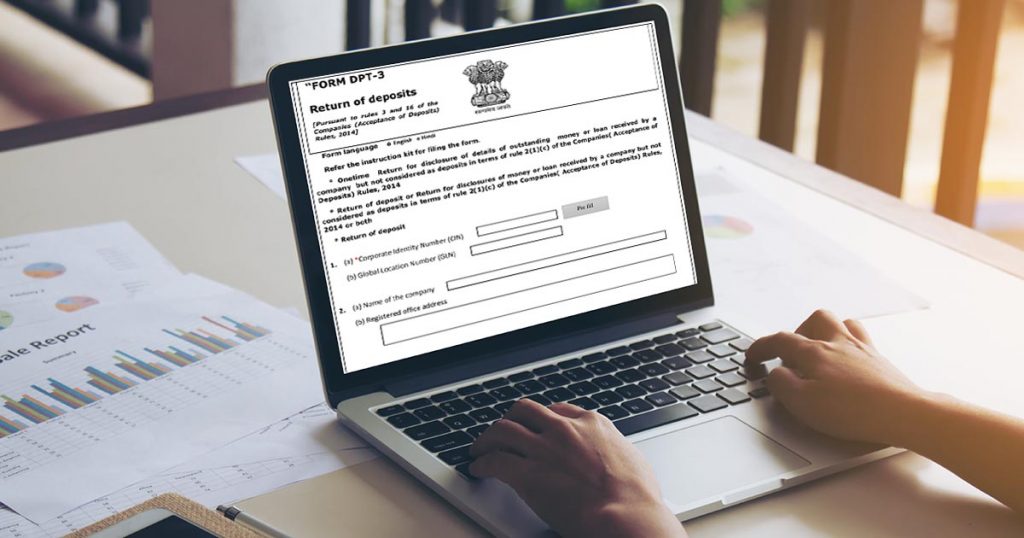

A Complete Guide to File DPT-3 Form (MCA) for Return of Deposits

What is Form DPT-3?

DPT-3 form is a one-time return form of loans that has to be filed by a company that has outstanding loans not treated as deposits.

According to the latest Ministry of Corporate Affairs (MCA) Amendments, it is mandatory for all the companies excluding the Government Companies to file a one time return for the outstanding receipts of money which are the loan of the company but are not considered deposits.

How did the Form DPT-3 Come into Existence?

On 22nd January 2019, the MCA (Ministry of Corporate Affairs) rolled out a new rule in the Companies (Acceptance of Deposits), Rules, 2014 and that new rule is DPT-3 form.

Companies (Acceptance of Deposits) Amendment Rules, 2019

MINISTRY OF CORPORATE AFFAIRS

NOTIFICATION

New Delhi, the 22nd January 2019

G.S.R. 42(E).—In exercise of the powers conferred by clause (31) of section 2 and section 73 read with sub-sections (1) and (2) of section 469 of the Companies Act, 2013 (18 of 2013), the Central Government, in consultation with the Reserve Bank of India, hereby makes the following rules further to amend the Companies (Acceptance of Deposits) Rules, 2014, namely:-

1. (1) These rules may be called the Companies (Acceptance of Deposits) Amendment Rules, 2019.

(2) They shall come into force on the date of their publication in the Official Gazette.

2. In the Companies (Acceptance of Deposits) Rules, 2014 (hereinafter referred to as the said rules), in rule 2, in sub-rule (1), in clause (c), in sub-clause(xviii), after the words “Infrastructure Investment Trusts,” the words “Real Estate Investment Trusts” shall be inserted.

3. In the said rules, in rule 16, the following Explanation shall be inserted, namely:- “Explanation.- It is hereby clarified that Form DPT-3 shall be used for filing return of deposit or particulars of transaction not considered as a deposit or both by every company other than Government company.”.

4. In the said rules, in rule 16(A), after sub-rule (2), the following sub-rule shall be inserted, namely:- “

(3) Every company other than Government company shall file a onetime return of outstanding receipt of money or loan by a company but not considered as deposits, in terms of clause (c) of sub-rule 1 of rule 2 from the 01st April, 2014 to the date of publication of this notification in the Official Gazette, as specified in Form DPT-3 within ninety days from the date of said publication of this notification along with fee as provided in the Companies (Registration Offices and Fees) Rules, 2014.”.

Who has to File The DPT-3 Form?

Except for the Government companies, all other companies which include all private limited companies, OPC, limited companies or Section 8 Company have to mandatorily file this form.

What is the Last Date (Due Date) to File the DPT-3 Form?

As per the Companies (Acceptance of Deposits) Amendment Rules, 2019, all the companies have to compulsorily file the one-time deposit return in E-form DPT-3 within 90 days form the end Financial Year 2018-19. While filing the return, the company has to give all the details about the outstanding receipt of money or debt which are not treated as deposits from 1 April 2014 to 31st March 2019.

Which Period Loans Must be Covered Under the Form DPT-03?

All Outstanding receipt of Money or Loan by the company prevailed from 1st April 2014 up to 22nd January 2019 must be covered under the DPT-3 form.

Should Form DPT-3 be Filed if there is no Outstanding Loan?

No, the DPT-3 form must not be filed if there is no outstanding receipt of money or loan.

Who is Applicable to File the DPT-3 Form?

- According to the rule 16A, DPT-3 must be filed by all the companies who have received money and loan which is due.

- The DPT-3 form must be filed by all the companies including small, private, non-small, OPC, etc.

- Both secured, unsecured Loans along with advance for goods and services must be filed in the DPT-3 Form.

- Even if the Holding Company or Subsidiary Company or Associate Company obtains the loan then it also has to file the DPT-3 Form

- If the company has not paid the loan before 1st April 2014 which is still continuing then such loans have to be reported to the ROC under the DPT-3 Form.

Who is not Applicable to File the DPT-3 Form?

- If the company does not have any loan till 22nd January 2019, then the filing of DPT-3 form is not required.

- If the company takes a loan after 1 April 2019 or pays it before 22nd January 2019 and there is no record of an outstanding loan then the company does not have to file the DPT-3 Form.

Who is exempt from filing the return?

Every company except a government company must file this return. Additionally, as per Rule 1(3) of the Companies (Acceptance of Deposits) Rules 2014, the following companies are also exempt:

- Banking company

- Non-Banking Financial Company

- A housing finance company registered with National Housing Bank

- Any other company as notified under proviso to subsection (1) to section 73 of the Act

Filing of DPT 3

DPT 3 has to file in two ways :

- One time return

- Annual return

Transactions not considered as deposits

- Any amount received from the government or guaranteed by the government, foreign government/foreign Bank.

- Any amount received as a loan or facility from any Public Financial Institutions, Insurance Companies or Banks

- Any amount received from a company by a company.

- Subscription to securities and call in advance.

- Any amount received from the director of the company or a relative of the director of the Private company, who held the positions at the time of lending.

- Any amount received by the company from an employee, not exceeding his annual salary under the employee contract such as non-interest bearing security deposit.

- Any amount received in the course of, or for the purposes of, the business of the company as an advance for the supply of goods or provision of services or as a security deposit for the performance of the contract for the supply of goods or provision of services.

- Receipt of Rs 25 lakh or more by a

- startup company in the form of a convertible note.

- Amount raised by the issuing secured bonds or debentures with first charge, non-convertible debentures not having a charge on the assets of the company.

- Unsecured loans from promoters.

- Any amount received by the company from Nidhi Company or by way of subscription in respect of chit under the Chit Funds Act, 1982.

- Any amount received by the company from collective investment scheme, alternate investment funds or mutual funds registered with SEBI.

- Any other amount which is not considered as a deposit under Rule 2(1)(c).

Hence any amount whether secured or unsecured and which is outstanding money or loan not considered as deposits must be reported.

Login

Login